Hey there, road warriors! Buckle up, because we’re about to take a joyride into the future of auto insurance. Forget everything you know about those stuffy old insurance policies your grandpa used to talk about. We’re diving into the wild, techy world of Telematics and Usage-Based Insurance (UBI). It’s like putting your insurance policy on autopilot but with fewer crashes and more savings. Let’s get rolling!

What the Heck is Telematics?

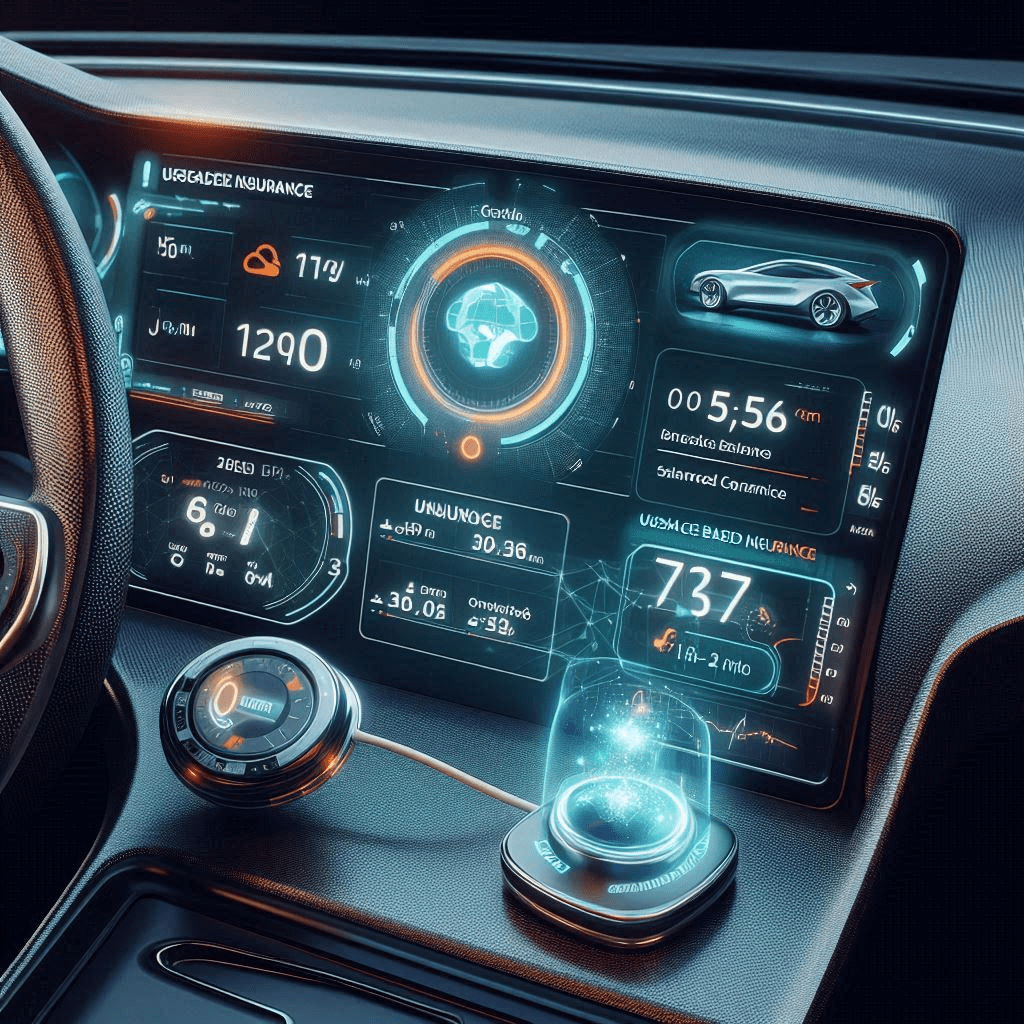

First things first, what’s this telematics thingamajig everyone’s buzzing about? Imagine if your car could talk to your insurance company. No, not like your chatty Aunt Linda at Thanksgiving, but more like a super-efficient, data-sharing whiz. Telematics involves gadgets that collect and transmit data about your driving habits. Think of it as your car’s personal fitness tracker, but instead of counting steps, it’s keeping tabs on how you drive. Speeding, braking, turning – your car’s got it all covered.

These gadgets can be installed in your car, or you might use a smartphone app. Either way, they’re sending info back to your insurance company faster than you can say “I swear that yellow light was still green!”

How Does Usage-Based Insurance Work?

Alright, so how does this high-tech wizardry translate into Usage-Based Insurance (UBI)? It’s pretty simple: the better you drive, the less you pay. It’s like getting a gold star in kindergarten, but with more cash in your pocket. Here’s the lowdown:

- Data Collection: That telematics device (or app) collects data every time you hit the road. It’s checking out your speed, how gently (or not) you’re braking, how sharply you’re turning, and even when you’re driving. No more 3 AM joyrides if you want those sweet discounts!

- Data Analysis: Your insurance company crunches the numbers and figures out how much of a daredevil you are. Safe drivers get rewarded with lower premiums. Speed demons and chronic tailgaters? Not so much.

- Premium Adjustment: Based on your driving data, your insurer adjusts your premium. Drive like a saint? Enjoy those savings. Drive like you’re auditioning for “Fast & Furious 42”? Better start saving up.

Why Should You Care About Telematics and UBI?

Personalized Premiums

Gone are the days when your insurance rate was based on broad categories like age, gender, and credit score. With UBI, it’s all about you, baby! Drive safely, and your premium reflects it. It’s personalized, just like your favorite coffee order at Starbucks (extra shot, no foam, light whip, caramel drizzle… you get the picture).

Promoting Safer Driving

Who doesn’t like a little positive reinforcement? When you know that good driving can save you money, you might think twice before flooring it at the green light. Many telematics systems even provide real-time feedback, turning your car into a rolling life coach.

Faster Claims Process

Accidents happen, even to the best of us. But when they do, telematics can make the claims process smoother than a freshly paved highway. With accurate data on the crash, your insurance company can settle claims faster and more fairly. Say goodbye to endless back-and-forths with claims adjusters.

Environmental Impact

Guess what? Driving smarter isn’t just good for your wallet – it’s good for Mother Earth too. Efficient driving habits reduce fuel consumption and lower emissions. Plus, if you’re paying attention to your driving data, you might find yourself driving less and opting for greener alternatives. Go you!

Let’s Talk Privacy

Now, I know what you’re thinking: “Isn’t all this data collection a bit Big Brother-y?” Fair point. Privacy is a big deal, and it’s crucial to know how your data is used. Reputable insurance companies are upfront about their data policies and use robust security measures to keep your info safe. Always read the fine print and choose a provider you trust. It’s like picking a babysitter – you want someone reliable and not snooping through your stuff.

The Road Ahead: The Future of Auto Insurance

Alright, crystal ball time. What’s next for telematics and UBI? As tech keeps evolving, we’re looking at even cooler ways to monitor and reward good driving. Think advanced machine learning and AI, predicting and preventing accidents before they happen. It’s like having your own personal pit crew, minus the grease stains.

And let’s not forget autonomous vehicles. As self-driving cars become more common, the focus of insurance might shift from you, the driver, to the car’s technology itself. It’s a brave new world, folks!

Conclusion: Ready to Embrace the Future?

Telematics and Usage-Based Insurance are revolutionizing the auto insurance game. It’s all about fairness, savings, and driving safer. So why not hop on this bandwagon (or should we say band-car)? Embrace the tech, enjoy the savings, and drive like you’ve got your mom in the passenger seat.

Whether you’re a lead-footed speedster or a cautious cruiser, there’s something in it for everyone. So go ahead, give telematics a whirl, and let your driving do the talking. Safe travels, and may the road rise up to meet you (but not too quickly – we’re watching that speedometer)!

Feel free to ask any questions, or just share your thoughts on this whole telematics thing. I’m all ears (and a bit of a data nerd, if you couldn’t tell). Drive safe, y’all!

Leave a Reply