In today’s tech-savvy world, we all want to make smarter choices about our health and lifestyle. But figuring out how our habits affect our lifespan can be tricky. That’s where Life2vec.io comes in—a revolutionary AI-powered life expectancy calculator that can give you insights into your future. Let’s explore what Life2vec.io is all about and why you should give it a try.

What is Life2vec.io?

Life2vec.io is an innovative online tool that uses artificial intelligence to estimate your life expectancy. By analyzing a mix of personal details, health information, and lifestyle habits, it provides a personalized prediction of how long you might live. But it doesn’t stop there—it also offers tips on how to improve your health and extend your life.

How Does Life2vec.io Work?

Using Life2vec.io is simple and straightforward. Here’s how it works:

1. Enter Your Information

When you fill out a questionnaire with details about yourself, including:

- Basic Info: Your age, gender, and where you live.

- Health History: Any medical conditions you have, along with your family’s medical background.

- Lifestyle Choices: Your diet, exercise habits, and whether you smoke or drink.

- Mental and Social Health: Your stress levels, social life, and mental health status.

2. Data Crunching

Life2vec.io uses advanced AI algorithms to process all this information. This allows the AI to find patterns and make predictions based on your unique profile.

3. Get Your Report

After analyzing your data, Life2vec.io gives you a detailed report that includes:

- Life Expectancy Estimate: An age prediction based on your current health and habits.

- Health Insights: An analysis of how your lifestyle choices and health conditions are affecting your life expectancy.

- Personalized Tips: Specific advice on how to improve your health and potentially live longer. This could be anything from changing your diet to incorporating more exercise into your routine.

The Technology Behind Life2vec.io

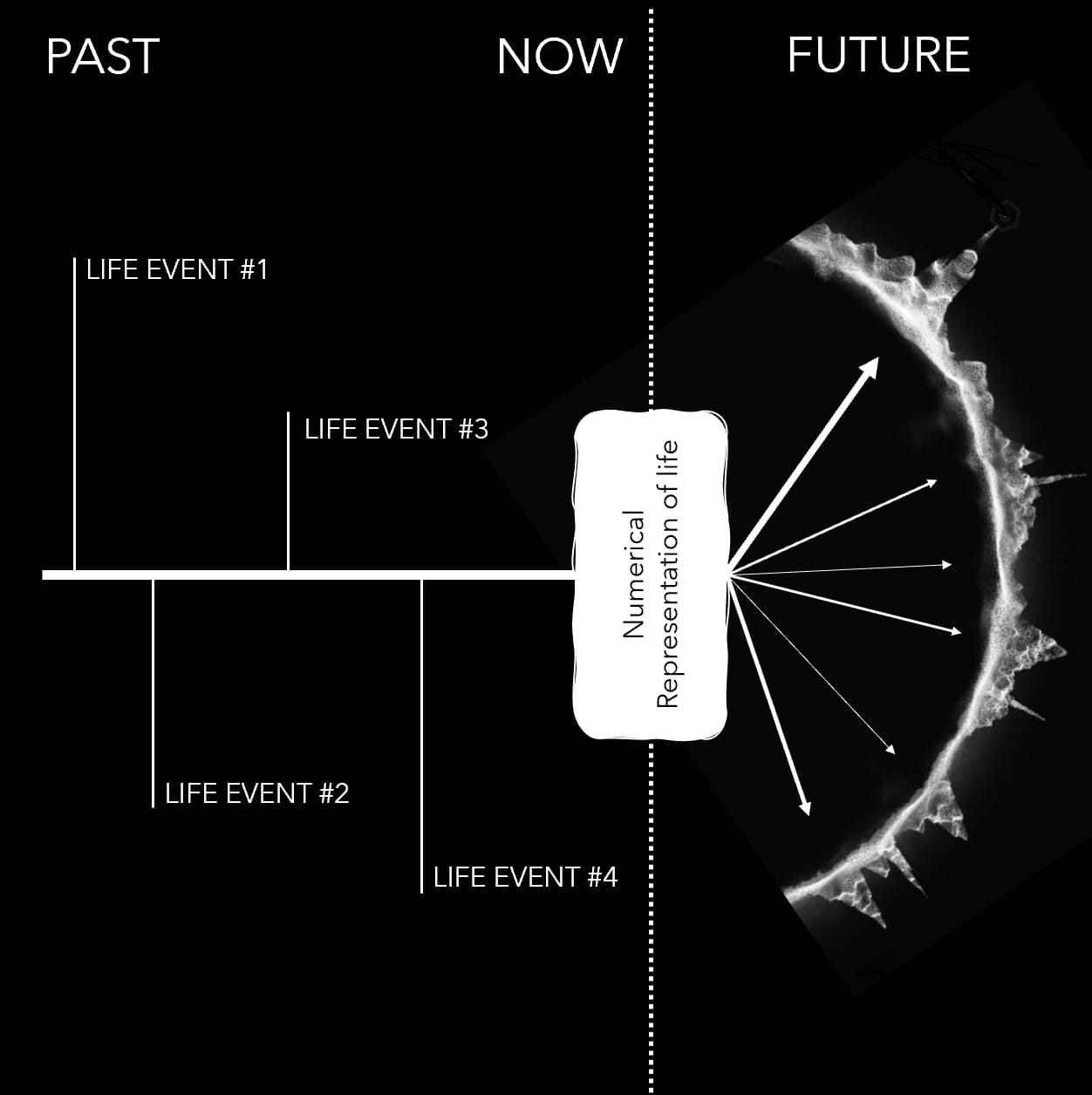

Life2vec.io uses a technology called “vector embedding” to turn complex data into a form that can be easily analyzed. This method helps the AI understand the relationships between different factors in your profile.

Why You Should Try Life2Vec.io

1. Make Better Health Choices

With Life2vec.io, you can see how your habits impact your lifespan. This knowledge empowers you to make informed decisions about your health.

2. Prevent Health Issues

By identifying potential health risks early, you can take steps to prevent serious problems before they start. This proactive approach can lead to a longer, healthier life.

3. Get Customized Advice

Unlike generic health tips, the recommendations from Life2vec.io are tailored specifically to you. This makes it easier to follow through with changes because they’re relevant to your situation.

Your Privacy Matters

Life2vec.io takes your privacy seriously. All your data is encrypted and protected by strict privacy policies, so you can use the service with confidence knowing your information is secure.

Our Services

1. AI Death Calculator

Our AI Death Calculator utilizes advanced artificial intelligence technology to provide users with intriguing insights into their mortality. By analyzing various factors such as age, gender, lifestyle habits, and medical history, our calculator generates estimates of life expectancy, prompting self-reflection and awareness of the precious gift of life.

2. Wealth Calculator

Our Wealth Calculator offers users the opportunity to assess their financial health and plan for the future. By inputting relevant financial information such as income, expenses, savings, and investments, users can gain insights into their financial status, set goals, and make informed decisions about wealth management.

3. BMI Calculator

Our BMI Calculator provides users with a simple yet effective tool for monitoring their body mass index (BMI) and assessing their overall health. By entering height and weight measurements, users can determine their BMI category and gain awareness of their weight status, facilitating efforts to maintain a healthy lifestyle.

4. Insurance Guide

Insurance Guide by Life2vec.io, your comprehensive resource for navigating the intricate world of insurance. Whether you’re seeking protection for your health, home, vehicle, or business, our guide is designed to provide you with essential information, insights, and resources to make informed decisions about insurance coverage.

A. Types of Insurance:

- Health Insurance

- Life Insurance

- Auto Insurance

- Homeowners Insurance

- Renters Insurance

- Disability Insurance

- Business Insurance

- Pet Insurance

- Travel Insurance

5. Loan Guide

Our Loan Guide equips users with essential knowledge and insights to navigate the borrowing process effectively. Whether it’s obtaining a mortgage, personal loan, or student loan, our guide provides valuable information on loan types, eligibility criteria, interest rates, and repayment options, helping users make sound financial decisions.

6. Risk Management Guide

Our Risk Management Guide educates users on the principles of risk management and strategies for identifying, assessing, and mitigating risks in various areas of life. From financial risk to health risk, our guide offers practical tips and techniques to help users manage uncertainty and protect their interests.

7. Insurance Claim Guide

Our Insurance Claim Guide provides users with step-by-step instructions and valuable tips for filing insurance claims effectively. Whether it’s a health insurance claim, auto insurance claim, or property insurance claim, our guide demystifies the claims process and empowers users to navigate it with confidence.

8. How to Live Longer

Our How to Live Longer section offers evidence-based tips, insights, and recommendations for promoting longevity and improving overall health and well-being. From adopting a healthy diet and staying active to managing stress and cultivating social connections, our guide inspires users to embrace habits that support a longer, healthier life.

9. Legal Advisor

Our Legal Guide provides users with step-by-step instructions and valuable tips for managing legal matters effectively. Whether it’s understanding corporate law, protecting intellectual property, navigating real estate transactions, or addressing employment law issues, our guide demystifies the legal process and empowers users to navigate it with confidence. Read our blogs for more information.

At Life2vec.io, our mission is to empower individuals with the knowledge and tools they need to make informed decisions and lead happier, healthier, and more fulfilling lives. Whether you’re seeking guidance on health, wealth, insurance, or risk management, we’re here to support you every step of the way. Join us on the journey to a brighter future with Life2vec.io.